|

|

The big news at our house is that we have a lawn! It was installed a few weeks ago and it's looking good. Best

of all, it's not yet long enough to mow and the cold weather is keeping it low. Pretty soon, I'm going to have to

buy a lawn mower, but til then I'm enjoying the view.

|

|

|

This month I'm looking at Spring Cleaning your finances, both business and personal and I'm including a Home

Budget Spreadsheet to

help you keep on top of your personal finances.

I'd also like to let you know about a service I've decided to formalise. A few times this month I've been asked if I can

offer business or personal financial advice in a one-on-one and the answer is absolutely yes.

I'm calling it a Catch Up, (but I might need to talk to the marketing department about that. Any suggestions?)

Anyway, the Catch-Up service has a cost, but I’m confident you’ll find it well worth the investment.

So, if you'd like to Catch Up with me for an hour one-on-one and discuss your finances, how your

business is going, look at the possibilities of setting up as a private practice, explore whether being an independent

contractor is for you, ask about financial things that have been bugging you

etc. etc. email me, I'd love to talk with you.

|

|

|

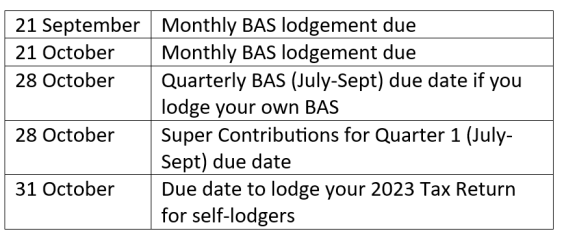

IMPORTANT DATES FOR TAX

|

|

|

|

SPRING CLEAN YOUR PERSONAL FINANCES

Spring cleaning your finances can help to improve your financial health and set you up for success in the coming

months.

Make a budget: If you’ve never made a budget before, now’s the time to do it. It’s a

great tool for keeping track of your money, and it’s a good motivator for saving towards future goals.

Review your budget: Take a look at your income and expenses and see where you can cut back or

make adjustments.

Make sure to include all of your regular bills and expenses, as well as any discretionary spending.

I've made a Home

Budget spread sheet for

you to help you to monitor your income and your spending.

This year when I was reviewing my expenses, I found that I’d subscribed to a comprehensive mobile phone service when my family

and I went travelling over a year ago, and I had forgotten to change it back. Opps. It really pays to check what

you've subscribed to!

Organize your financial documents: Go through all of your financial documents, including bank

statements, bills, and tax returns, and organize them in a way that makes sense for you.

Last year I set up electronic folders for my bills, bank statements and share statements and so far it seems to be working

nicely.

This year, my goal is to keep really good track of my tax deductions. I’m using the ATO app My Deductions tool.

It means I can take a photo and keep a record of all the bits and pieces of work-related spending that usually end up floating

around in my workbag. All those parking receipts, stationery costs will add up and save me a bit on my tax bill.

Review your utilities: We all know that energy prices are a major cost to households. Take a

look at the government website Energy

Made Easy

where you can compare energy plans to see if you’re getting a good deal.

Evaluate your investments: Review your investment portfolio and make sure that it is diversified

(i.e. not all of your eggs in one basket) and aligned with your risk tolerance (i.e. not keeping you awake at night

with worry) and investment goals (i.e. earning you money either by paying you a dividend or increasing in value).

With a bank savings account earing around 4.5% I want to make sure the shares I purchased for dividends are worthwhile, so

I’ll be checking on that.

Get around to investing in shares: If you haven’t invested before, there are some great micro

investing options available that give you the chance to learn about investing in shares at a very low cost. You

can start with just $5. Check out Raiz or Sharsies.

Set financial goals: Take some time to think about your personal financial goals for the

next 6-12 months. You might want to reward yourself with a holiday or set yourself a target to save for a home

deposit. Whatever it is, make a plan to achieve it and set some deadlines so you have something to work

towards. If you’d like some online inspiration for this, check out Tasha Gets Frugal on Instagram an

honest and encouraging account by a person who has embraced budgeting and financial goals to overcome her consumer debt

and start some serious saving.

Automate your savings: Set up automatic contributions to your savings or investment

accounts to make saving easier and more consistent. Some banks even reward you with bonus interest for

making payments into your savings.

Pay yourself super: If you're self-employed, the responsibility of contributing to your

superannuation falls on your shoulders. While it’s not mandatory, it's a decision that can really impact your future

quality of life and it’s usually tax deductable. You’ll need to check with your super fund and also fill in an

intent to claim form each year. It’s a great idea to set up a regular automatic payment to your super

account.

Review your insurance: Check your insurance coverage and make sure that you have the right

amount and type of coverage for your needs. I know this is a big ask because comparing insurance policies is

really tricky. I usually choose one type of insurance to review and research it at spare moments over a few days,

make a decision and then give myself a few weeks break before moving on to the next insurance product. The

government has a website to help compare private health products www.PrivateHealth.gov.au .

I also like to ask around among my friends and colleagues to see if what seems ridiculously high is actually a fair

price.

Remember if your taxable income is over $90,000 and you don’t have private health insurance you will

need to pay the Medicare levy surcharge which is 1.5% on top of the 2% Medicare levy that you already pay.

Some psychologist clients who have faith in the public system have found themselves purchasing private health

insurance in order to avoid the Medicare levy surcharge which, depending on your income, can be a fair amount.

It’s a good idea to have a quick look at your health insurance and make sure it’s suited to your time of life. If you’re

thinking about starting a family be sure to have the elements related to pregnancy and birth included in your health

insurance. If you’ve been there and done that, it’s a good idea to check that you’re no longer paying for those

items.

The other insurance that can make a big difference for the people you care about is Personal insurance.

This is Income Protection Insurance, Total and Permanent disability insurance, Trauma Insurance and Life

insurance.

These insurances will give a payout if you are injured and unable to work or if you die. We all hate thinking

about these things, but they are a safety net. Check if you are covered for any of these under your super fund or

you may want to purchase a policy. In my Spring Cleaning I’ll check that the payout will cover the cost of

my home mortgage, so my family won’t need to worry about debt if I were to die. If you’d like more information

about these types of insurance the financial advisors here at Sheridans can help you out.

I hope these tips help you feel refreshed and in control of your finances.

|

|

|

|

HOW TO SET GOALS FOR YOUR PSYCHOLOGY BUSINESS

Setting goals for your psychology business is key to ensuring growth, stability, and long-term success. Here’s a

step-by-step guide to help you effectively set goals:

1. Clarify Your Vision

-

Define your long-term vision for your psychology business. Where do you see yourself in 3, 5, or 10 years? This

overarching vision will serve as the foundation for setting specific goals.

2. Identify Key Areas

Focus on different aspects of your business that are crucial to its success. Examples include:

- Client Acquisition and Retention: Expanding your client base or improving client retention rates.

- Financial Goals: Increasing revenue, reducing expenses, or meeting specific profit margins.

-

Professional Development: Attending workshops, gaining certifications, or advancing your skills in a

specific therapy technique.

-

Business Operations: Streamlining processes, improving client management systems, or optimizing marketing

efforts.

- Work-Life Balance: Setting boundaries to avoid burnout and maintain a healthy personal life.

3. Set SMART Goals

-

Specific: Clearly define what you want to achieve. For example, "Increase client base by 20% over the

next six months" is more specific than "Grow the business."

-

Measurable: Ensure your goals can be tracked with quantifiable metrics, such as the number of new clients

or revenue growth.

-

Achievable: Set realistic goals that are challenging but attainable given your current resources and

circumstances.

-

Relevant: Align your goals with your overall business vision and priorities. Focus on what matters most.

-

Time-bound: Establish deadlines or time frames for each goal, such as quarterly, annually, or by specific

milestones.

4. Break Down Goals into Actionable Steps

-

Once you’ve set your goals, break them down into smaller, actionable steps. For instance, if your goal is to increase

client acquisition, your steps might include improving your online presence, or networking with referral sources.

5. Monitor and Adjust

-

Regularly review your progress toward each goal. Set aside time each month or quarter to assess whether you're on track

and make adjustments as necessary. Be flexible and open to revising your goals if circumstances change.

6. Celebrate Milestones

-

Recognize and celebrate your achievements along the way. Celebrating milestones can keep you motivated and energized as

you work towards your larger goals.

7. Seek Feedback and Support

-

Don't hesitate to seek advice or feedback from mentors, colleagues, or even clients. They may provide valuable insights

that can help refine your goals or identify new opportunities.

8. Balance Personal and Professional Goals

-

Make sure your business goals align with your personal values and desired lifestyle. Striving for business success

shouldn’t come at the cost of your well-being.

9. Document Your Goals

-

Write down your goals and keep them visible. Documenting them makes them more concrete and helps you stay focused on

achieving them.

By following these steps, you can create clear, achievable goals that drive the growth of your psychology business while

also ensuring you maintain balance in your professional and personal life.

|

|

|

|

SPRING CLEANING FOR BUSINESS FINANCES

Spring cleaning your business finances is a great way to ensure your financial records are organized and up-to-date

giving you a strong foundation for your business.

Review Outstanding Invoices and Payments: Check for outstanding invoices that haven't been paid and

follow up with clients or health care providers as necessary. Also, ensure you've paid all your bills and suppliers.

Get your cashflow sorted – Start building up the cash reserve in your business. Having two to

three months of your wages in your bank account gives you an excellent buffer to cover any unforeseen issues that

may arise.

I’ve said it before and I’ll say it again: Keep your personal and business financial data separate. If

you’re a sole trader, it’s easy to be tempted to use your business account to pay for personal items. However,

the challenge of deciphering the information at the end of the year adds significantly to your accounting bill.

Organize Tax Documents: Ensure all your tax-related documents are in order and easy to find.

Keep your receipts. The ATO app is actually really useful for this.

Set up a system to put aside money for tax: As you know I have a bee in my bonnet about this

(for more information see my previous newsletter). Be prepared for your tax bill by putting money aside. This is

especially important in your first 2 years of business when you’ll have a tax bill at the end of the first year and

then you'll have pay as you go installments from your second year onwards. If you're not prepared at the end

of your first year, you'll put yourself behind the 8 ball.

Automate Where Possible: Consider automating recurring financial tasks like bill

payments, invoicing, paying super to yourself and payroll to reduce manual work and minimize errors.

Assess Your Budget and Financial Goals: Think about what you really want from your business.

Evaluate your personal and financial goals and make adjustments, if needed, to align with your business's current

status and future plans.

If you’d like to talk through your earnings forecast and your business aims, I’d be happy to discuss these with

you. Just get in touch.

|

|

|

|

Have a productive month!

All the best,

Fairuz & the Accountant for Psychologists Team

|

|

|

|

My aim is to help you understand your finances and take control of your financial future. I want to help you make

strong, well-informed decisions and be financially well prepared if difficulties arise.

I call it ‘Being Sorted.’

So, I’ve put together this book to give you a structured approach to becoming financially well organised.

Part 1 – Get Sorted. Fill in my Sorted checklist to find your starting point on your journey to becoming

Sorted. Then use the information in Part 2 to get on your way.

Part 2 – Sorted. Outlines the eight key areas of personal finance:

• Personal Budgeting

• Savings

• Investments

• Taxation

• Debt

• Insurance

• Retirement

• Estate Planning

I assure you that if you follow this guide, you’ll be much better off financially than when you first started.

|

|

|

Accountant for Psychologists is a part of Sheridans Accountants & Financial Planners

Accounting, Bookkeeping, Mortgage Broking, Financial Planning, Business Coaching, Personal Finance Coaching,

Self-Managed Super Funds

|

|

|

The greatest compliment we receive from our clients is the referral of their friends, family and business colleagues.

Thank you for your support and trust.

Visit the

Accountant for Psychologists Website | Visit

the Sheridans

Accountants Website

Phone (08) 8376 0455

IMPORTANT DISCLAIMER: This newsletter is issued as a guide to clients and for their private

information. This newsletter does not constitute advice. Clients should not act solely on the basis of the material

contained in this newsletter. Items herein are general comments only and do not convey advice per se. Also changes in

legislation may occur quickly. We therefore recommend that our formal advice be sought before acting in any of these

areas. Liability limited by a scheme approved under Professional Standards Legislation

Copyright © 2024 Accountant for Psychologists, All rights reserved.

You are receiving this email because you opted in via our website.

Our mailing address is:

Accountant for Psychologists

593 Anzac Hwy

Glenelg North, SA 5045

Australia

Add us to your address book

|

|

|

|

|

|